Riyadh’s AI & Data Centres Summit on 29 30 October 2025 was a watershed moment for Saudi Arabia’s technology strategy. The gathering shifted focus from lofty AI ambitions to the nuts and bolts of building an infrastructure capable of sustaining large‑scale AI workloads. Instead of broad promises about artificial intelligence, speakers dove into specifics: how many substations would be required, how much transmission line must be built, how to source water for cooling, and how to codify data sovereignty. The message was clear: AI is now treated like critical infrastructure no longer a luxury, but a necessity that requires serious engineering and policy work.

In the background, the Kingdom’s National Data Centre Strategy, renewable‑energy buildout and draft Global AI Hub Law are converging. Together, they aim to create a domestic environment where sensitive AI workloads can be processed safely, efficiently and with minimal environmental impact. For investors, this is not a hype‑driven story but a call to underwrite tangible assets such as power generation, transmission and desalination, alongside forward‑looking legal frameworks.

The global context: AI as an industrial load

Recent GPU generations have turned AI into one of the most demanding industrial loads on the planet. As large language models and generative AI applications proliferate, the underlying compute clusters behave like baseload plus power consumers. A single AI training job can run for weeks, drawing tens of megawatts continuously. In markets like the U.S. and EU, this shift has exposed weak points: ageing grids, limited substation capacity, long interconnection queues and escalating concerns over water use.

In response, hyperscalers have started to site their training clusters near abundant, low‑carbon power sources hydro in Canada, nuclear in Virginia, geothermal in Iceland and have invested heavily in liquid cooling to reduce water consumption. Meanwhile, regulators have pushed for data sovereignty laws to keep sensitive workloads within national borders and under local jurisdiction. Saudi Arabia has assimilated these lessons. It understands that AI infrastructure now requires the same planning and regulatory attention as a refinery or a port. Hence its decision to expand the electricity grid, modernise desalination, and draft a law for AI hubs.

Key global trends at a glance

- Power access is the new bottleneck. In mature markets, connecting a 50 100 MW data centre can take several years. Saudi Arabia seeks to shorten this by centrally planning substations and transmission ahead of demand.

- Water is under scrutiny. Traditional evaporative cooling can consume millions of litres per day. Globally, operators are shifting toward direct‑to‑chip and immersion cooling to reduce water use. Saudi Arabia relies on desalination but must account for the energy cost embedded in every cubic metre produced.

- Data sovereignty rises in importance. Countries are enacting laws that require sensitive AI workloads to stay within their jurisdiction. Saudi Arabia’s draft Global AI Hub Law fits into this global movement.

GCC and MENA landscape

Competition within the GCC to host AI workloads is intensifying. The UAE promotes ecosystems like Masdar City and invests in quantum and AI research. Qatar emphasises its high‑performance computing capabilities. However, Saudi Arabia’s advantage comes from scale and integrated planning.

Through the National Renewable Energy Program (NREP), Saudi Arabia has tendered roughly 64 GW of renewable capacity by the end of 2025. Recent awards include 4.5 GW of projects (1.5 GW wind and 3 GW solar) with record‑low tariffs around 1.1 1.5 cents per kWh. These tenders not only decarbonise the grid but also provide a reliable, low‑cost power pool for data‑centre operators to draw from. The Saudi grid is also being physically expanded to accommodate these renewables, with new substations and long‑distance lines under construction.

Neighbouring countries, though agile in offering free‑zone incentives and connectivity to global networks, do not yet match the combined scale of Saudi Arabia’s renewable buildout, grid expansion and policy emphasis on sovereign compute. The Kingdom is betting that its ability to provide gigawatt‑scale clean power and clear regulatory assurances will attract hyperscalers and sovereign clients who need high density AI compute.

GCC/MENA highlights

- Tender pace and volume: 64 GW of renewables tendered by end‑2025; recent rounds achieved world‑record low power prices.

- Grid interconnectivity: Saudi Arabia plans cross border HVDC links to Egypt and Jordan, enhancing regional power balancing.

- Regional competitors: UAE, Qatar, Bahrain and Oman each offer different incentives but generally lack the integrated power‑water‑law package Saudi Arabia is assembling.

Saudi domestic market: growth trajectory and infrastructure

Market size and IT load

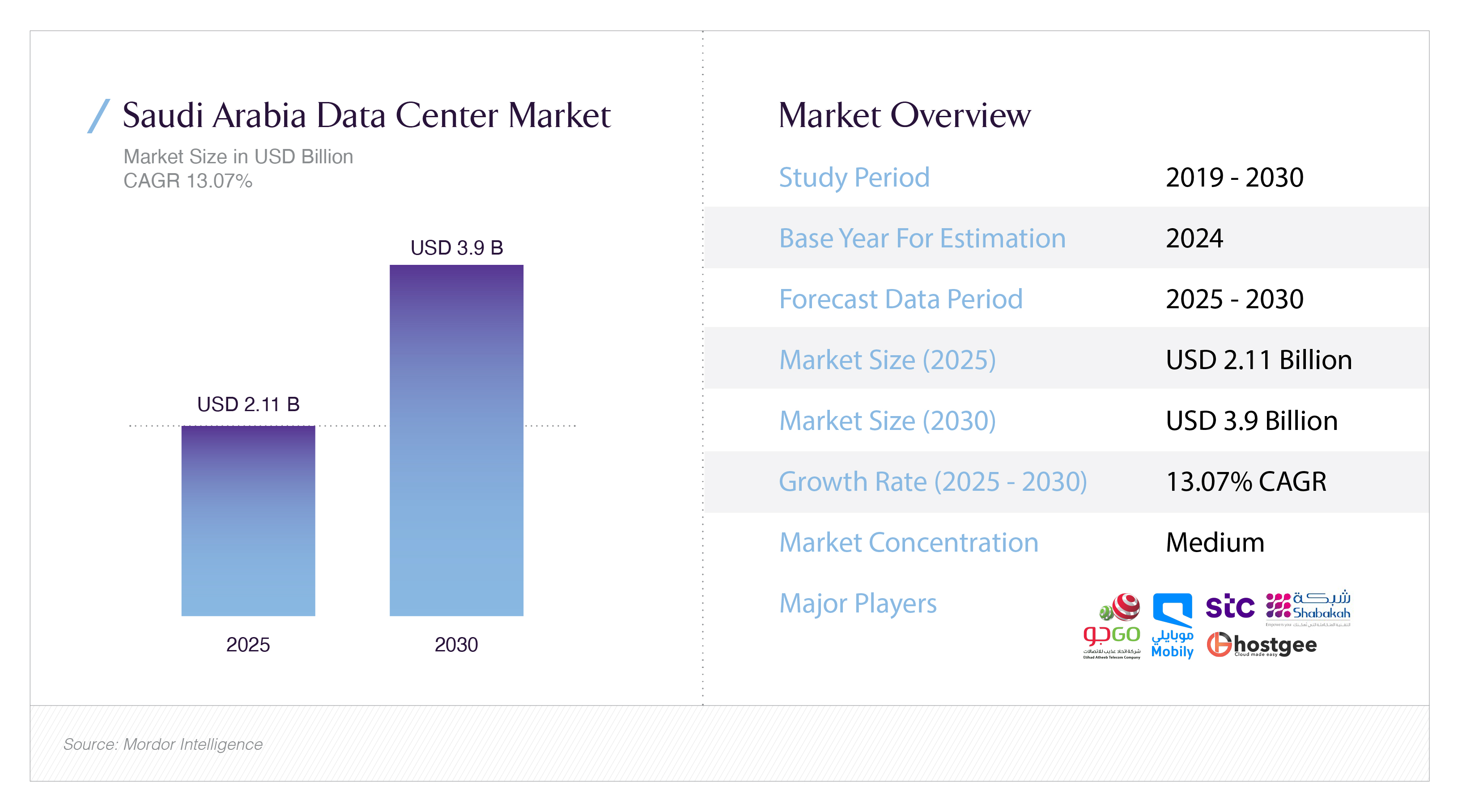

The Saudi data‑centre market is projected to grow from approximately US$ 2.11 billion in 2025 to about US$ 3.9 billion by 2030. During the same period, IT‑load capacity is expected to more than double, from roughly 0.41 GW to 1.03 GW. These projections imply a 13 % CAGR, reflecting both new entrants (global hyperscalers building region specific “regions”) and domestic initiatives aimed at sovereign AI compute.

The accessible chart from Mordor Intelligence presents this trajectory graphically, showing parallel growth in market value and IT‑load over 2025 2030. This is the only publicly available visual identified; when publishing, replace the all‑caps marker above with the re‑branded chart.

Water consumption

With greater compute density comes greater cooling demand. A Mordor study estimates that Saudi data centres used around 20.18 billion litres of water in 2025 and could reach 87.5 billion litres by 2030. This growth implies a 34 % CAGR higher than revenue growth. To manage this, the Kingdom’s regulators and developers are encouraging liquid cooling and district cooling tie‑ins, which can significantly reduce water draw per unit of compute. Nevertheless, each litre consumed carries an embedded energy cost: SWCC’s most efficient reverse‑osmosis plant requires around 2.27 kWh per cubic metre. This interlink between power and water means that investors must evaluate cooling choices through both lenses.

Legal framework

At the heart of Saudi Arabia’s sovereign compute ambition is the draft Global AI Hub Law. Launched for consultation in April 2025, the law aims to establish designated hubs where sensitive data and AI model weights must reside. These hubs will have strict requirements for cybersecurity, key management, data segregation and auditability. The law also outlines rules for cross border data transfers, ensuring that data moved out of the Kingdom meets equivalent protections.

For operators and investors, the law offers clarity: sensitive sectors (defence, finance, healthcare) will need to host workloads within Saudi Arabia, creating a baseline of demand. It also sets a compliance framework that can be incorporated into service‑level agreements. However, details remain to be finalised; the implementing regulations will determine how onerous or flexible the requirements are.

Saudi market and infrastructure overview

- Projected revenue: ~US$ 2.11 bn (2025) → ~US$ 3.9 bn (2030).

- Projected IT load: ~0.41 GW (2025) → ~1.03 GW (2030).

- Water use forecast: ~20.18 bn L (2025) → ~87.5 bn L (2030).

- Grid expansion: 24 substations and ~4,327 km of transmission lines are under construction to connect ~34.4 GW of renewables by 2027.

- Renewables pipeline: 64 GW tendered by end‑2025, with record low renewable LCOEs around 1.1 1.5 cents/kWh.

- Legal milestone: Draft Global AI Hub Law to codify data residency and model‑weights escrow (final text pending).

Challenges for investors

Even with supportive policies, there are real risks that investors must underwrite in building Saudi AI campuses.

Synchronising power delivery is the first challenge. Data‑centre developers typically need 50 100 MW per phase. If substation or transmission projects run late, facilities could sit idle, stranding capital. The solution is rigorous coordination with SEC to align campus COD with grid COD, and to include contingency plans (e.g., temporary generators or energy storage).

Managing thermal density is another challenge. Future GPUs will push rack densities beyond 50 kW; air cooling will not suffice. If campuses are designed for air but need to retrofit to liquid, costs rise and downtime accrues. Investors should therefore ensure that new facilities are liquid ready from the start pipes, pumps and heat exchangers sized for future densities.

Accounting for water‑energy coupling requires more than meeting a WUE metric. The energy cost embedded in desalinated water must be factored into total emissions and operating expenses. Contracts should specify the origin desal plant and reflect its efficiency and the grid’s carbon intensity at the site.

Supply‑chain variability adds complexity. GPU shipments remain volatile due to supply shortages and export controls. Modular designs that scale in 20‑MW increments can mitigate this, allowing capacity to come online as chips arrive. Multi vendor partnerships can also reduce risk.

Human capital may be the most underrated challenge. High density, liquid‑cooled AI campuses require trained technicians to operate high voltage equipment, maintain cooling loops and manage secure zones. Saudi Arabia will need to invest in education and certification programs to develop this workforce.

Solutions and best practices

Saudi Arabia is tackling these challenges through coordinated policy and investment.

Power first planning: Developers are encouraged to choose sites near SEC’s planned dual‑fed substations. Early engagement with the utility secures interconnection positions and ensures that power is available when GPUs arrive. Coupling these sites with renewable PPAs and battery storage provides firm, low‑carbon electricity.

Water efficient cooling: Liquid cooling is becoming the norm in new builds, reducing water use and enabling higher rack densities. In urban areas, tying into district cooling networks can further reduce water consumption and facilitate heat reuse into neighbouring buildings. Contracts can link water pricing to the efficiency of the supplying desal plant and reward operators for meeting stringent WUE targets.

Modular, phased development: Building data centres in blocks of 10 20 MW allows flexibility. Each block can be commissioned when GPUs and customers are ready, avoiding overbuild risk. Modules can be designed to support future retrofits, so they are adaptable to new cooling technologies or power densities.

Governance compliance: Facilities should incorporate the requirements of the forthcoming AI Hub Law into their design, including air gapped areas for sensitive workloads, sovereign key management and audit trails. These features will appeal to government and regulated‑industry tenants.

Talent development: Collaborations between SDAIA, universities and hardware vendors can create training programs in high voltage systems, liquid cooling, AI workload optimisation and cybersecurity. A robust talent pipeline ensures operational excellence and reduces reliance on foreign expertise.

Benefits for investors and the Kingdom

Economic resilience

Data‑centre infrastructure financed by long term PPAs offers stable, predictable cash flows. Revenues come from sovereign entities, hyperscalers and regulated industries that require domestic AI compute. Because compute demand is growing and barriers to entry are high, these assets can behave like regulated utilities, offering attractive yields and steady inflation indexed returns.

Sovereignty and strategic independence

Hosting AI workloads domestically reduces reliance on foreign clouds and mitigates geopolitical risks. Sensitive models those related to defence, financial regulation or healthcare can stay within Saudi territory. This enhances national security and ensures that the Kingdom controls its critical AI infrastructure.

Job creation and economic diversification

Building and operating AI campuses creates skilled jobs across electrical engineering, mechanical systems, software, and operations. It also stimulates adjacent industries like renewable energy, battery manufacturing and education. Over time, this contributes to diversifying the economy away from hydrocarbons.

Environmental leadership

By integrating renewables and adopting water‑efficient cooling, Saudi Arabia can deliver AI compute with lower carbon and water footprints. This aligns with the Saudi Green Initiative, which aims to reduce emissions and restore ecosystems. Low‑carbon AI capacity will be attractive to multinational companies under ESG mandates.

Key milestones to monitor

- Substation energisation progress: Track SEC’s updates on new substations and transmission lines to assess power‑availability risk.

- Renewable and storage awards: Follow SPPC tenders to understand the price and volume of future renewable capacity.

- AI Hub Law implementation: Watch for the final text and guidelines, which will set compliance requirements for operators.

- GPU delivery schedules: Pay attention to announcements from chip manufacturers and any new export controls that could affect supply.

- Operational metrics: Encourage operators to publish power‑usage effectiveness (PUE) and water‑usage efficiency (WUE) figures, along with the energy intensity of their water source.

Conclusion

Saudi Arabia’s AI & Data Centres Summit signalled that the Kingdom has moved from aspirational AI strategies to concrete infrastructure planning. It is building the grid capacity, renewable supply, water resources and legal frameworks needed to host AI as a critical, utility‑class load. While only one publicly accessible chart was available for reference, the underlying data market doubling by 2030, IT load surpassing 1 GW, tens of gigawatts of renewables being integrated, and world record desalination efficiencies supports the thesis that Saudi Arabia is positioned to become a leading hub for low carbon, sovereign AI compute. Investors should take note: this is an opportunity grounded in physical and legal infrastructure, not speculative enthusiasm.